A change to Australia's JORC code and the deployment of a new platform may tell the tale of the rest of K2fly's year.

The company, which calls itself a resource governance software solutions provider, recently completed its cloud-based Resource Disclosure platform, a reworking of its RCubed software.

That platform was most recently sold to Vale, marking K2fly's first deal with the Brazilian iron ore giant, via a $1.92 million, three-year contract expected to reap $473,000 in annual recurring revenue.

K2fly chief executive officer Nic Pollock told an investors' call following the release of the company's March quarter results that Arcelor Mittal and Eramet had also signed on to the platform.

YOU MIGHT ALSO LIKE

"We're in the process of migrating RCubed clients across to Resource Disclosure," Pollock said.

"Anglo American are coming down the path of implementation."

JORC joy

Pollock believes the release of an updated JORC code later this year will be a boon for K2fly.

"We've seen where companies have changed codes, it drives big business for us," he said.

"We're seeing a significant uptick in interest from Australian Securities Exchange-listed companies.

"Our annual recurring revenue growth comes from that same group."

Pollock said opportunity lay in miners turning their focus towards environmental and social governance.

"Mine planning starts at cultural heritage these days," he said.

It just so happens K2fly has a product that can help miners manage their cultural heritage obligations.

"K2fly is creating a new space in the industry, one that is being readily adopted by global mining companies," Pollock claimed.

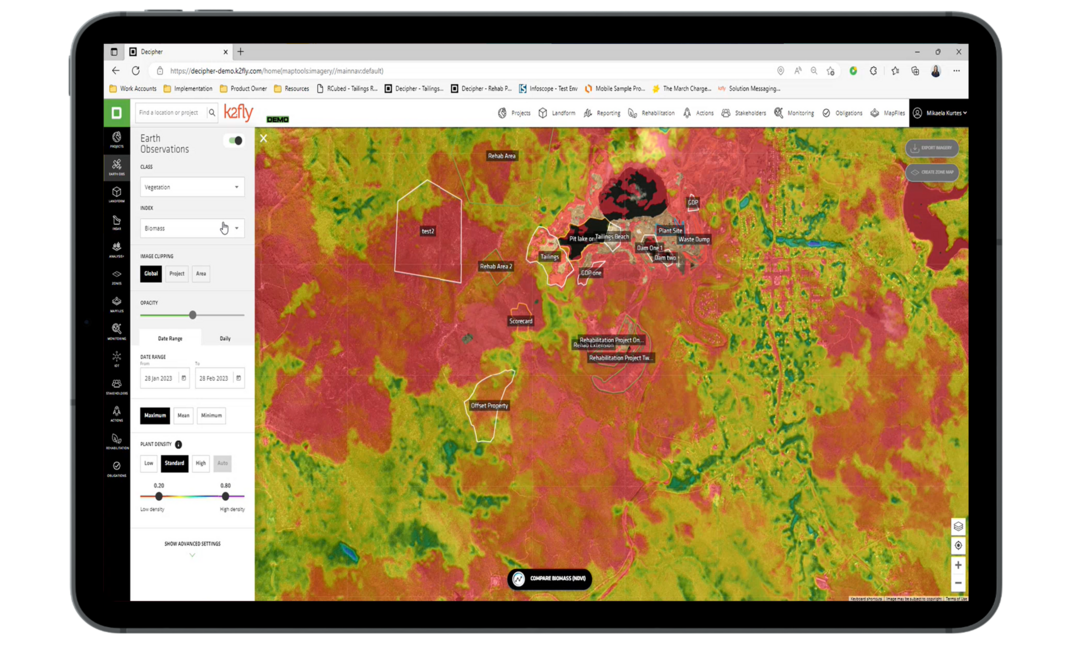

"We break the area into two areas: natural resource governance and mineral resource governance."

In K2fly's world natural resource governance covers everything above the ground, while mineral resource governance is for what lies beneath.

"Miners need access to land and a resource," Pollock said.

"Without them they don't have a mining company.

"Below ground, the typical investor can't see that."

Pollock described K2fly's mineral resource governance tools as a form of inventory of the miner's resources.

"We provide a system that supports the global standards about how you disclose and present the auditability of this.

"We call this the golden thread. It's all about your public disclosures. They are increasingly being viewed and considered not just by investors but by regulators.

"You might have a licence to operate but not a social licence to operate."

Peter Johnson, chairman of K2fly's largest shareholder Maptek, said ESG was an area miners were paying a lot of attention to.

He said that was part of the reason Maptek invested in K2fly.

Pollock insists K2fly is not about creating standards but rather meeting them.

"We build solutions to support the client to meet these standards."

Selling 'sticky' software

Pollock said the uniqueness of the company's offering made its software "sticky".

"We're often replacing in-house software or things that don't exist," he said.

K2fly's 12-month gross retention rate sits at 98%.

"We've been doing this for four to five to five years in earnest in terms of software solutions," Pollock said.

"We've just gone into our fourth renewal with one of our major clients.

"This is very sticky software. It does things that are critical for these companies. It protects their social licence to operate and ensures they meet mining standards, speed up mining approval processes, and reduce the potential for greenwashing."

Pollock believes the stickiness of the software gives the company an advantage when it comes to renegotiating licence renewals.

"Because we're the only provider of these solutions we have some price power," he said.

The sales model for K2fly's software calls for annual payments over the contract term with consumer price index increases factored in.

Pollock said the company sought to make the value argument when it came to contract renewals.

"Because of the sticky nature of what we're doing and having delivered value over these contracts we can come from a fairly strong position," he said.

"One order was around a 60% increase. But everyone is a bit different."

It should be pointed out that K2fly is not the only mining software player moving into the ESG space.

The much larger RPMGlobal – it has a $553.2 million market cap –has made strides in this area too.

In 2021 it made two purchases in this area because it too believes ESG will be an area replete with opportunities.

Financially speaking

K2fly's revenue from new customers comes in two forms: the initial sign-on for the software, and payments for the implementation of the solution.

Finishing several implementation projects in prior periods meant less implementation services revenue for the March quarter. Therefore, the $2.9 million for the period was down quarter-on-quarter.

More importantly annual recurring revenue grew 5% to $8.3 million quarter-on-quarter and was up 19% on the 2023 March quarter. Had the Vale deal been signed a couple of week's earlier, it would have taken the quarter's ARR to $8.8 million.

Total contract value at quarter's end was $17.9 million.

Last year K2fly started a strategic review and a hunt for cost savings in the business.

It hired Argonaut and Atrico to try and help it determine the best corporate structure to help what Pollock called a "micro cap" – it has a market capitalisation of $15.5 million – to best raise capital and realise its potential.

The news on the strategic review is that there is no news.

"We never expected it to be a quick process," Pollock said.

In terms of costs, K2fly has implemented a series of savings, which included staff redundancies of which $100,000 was settled during the March quarter, and restructuring.

On the call K2fly chief financial officer Sara Amir-Ansari took pains to point out that the cuts had been made to overhead and not "direct client impacting areas".

Beyond the pit

Pollock said K2fly was starting to look outside the mining sector for further growth.

One area it is looking at is where a piece of infrastructure, such as a rail line, a pipeline or a cable covers a fair bit of ground.

"These are items that cross many boundaries," Pollock said.

K2fly's software can help with that.