Waste not want not could soon become the catchcry for Australian miners as greater attention gets turned to pulling metals from waste streams, including the old tailings dams dotted around the country.

Geoscience Australia and the Minerals Research Institute of Western Australia have already headed down this path.

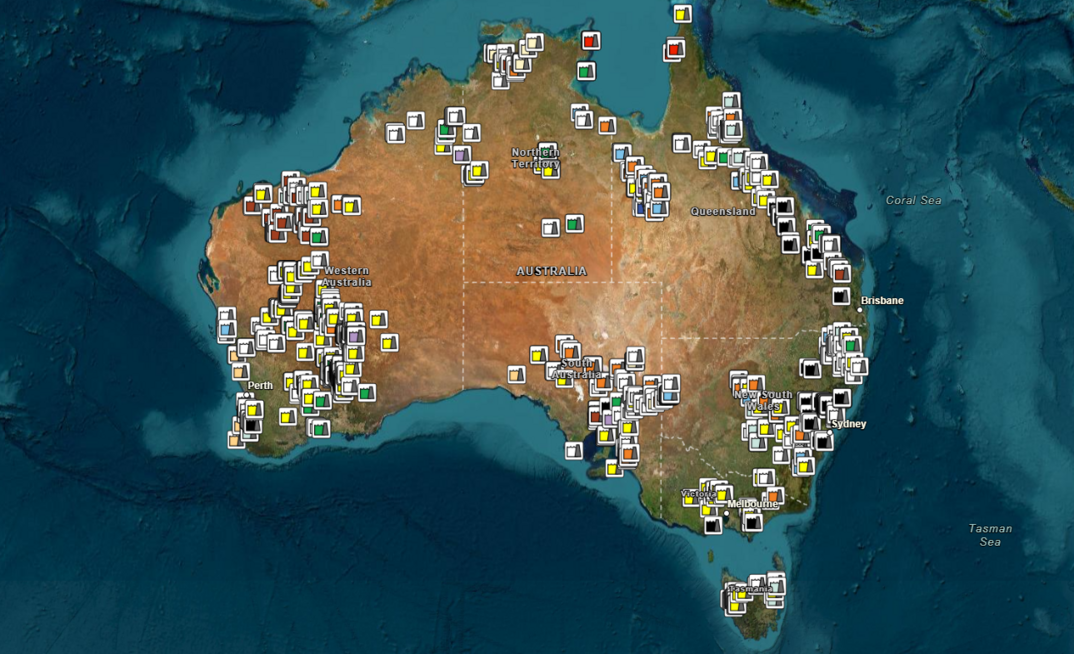

In 2022 GA, in partnership with the University of Queensland, RMIT University and the Geological Survey of Queensland, started developing the Atlas of Australian Mine Waste. It has also taken input from the Geological Survey of New South Wales, the Northern Territory Geological Survey, the Geological Survey of Victoria, the Geological Survey of South Australia, the Geological Survey of WA and Mineral Resources Tasmania.

So far the atlas has identified 1050 sites across Australia as possible sources of critical minerals.

YOU MIGHT ALSO LIKE

MRIWA is working on a similar concept.

Last year MRIWA chief executive officer Nicole Roocke told Australia's Mining Monthly that more attention would be paid to tailings storage facilities and waste dumps as critical minerals demand grew.

"Companies are giving consideration to how they process that waste rock to extract the various critical minerals and products," Roocke said.

MRIWA is considering the type of exploration effort needed to determine what is in some of the legacy TSFs around WA.

That project is ongoing.

The GA waste atlas aims to identify opportunities for critical minerals supply from secondary sources.

It is making use of a concept called secondary prospectivity.

There is the added benefit of finding value in previously discarded mining waste and potentially removing toxic residues from the land. Think of the environmental, social and governance benefits to be had.

Steep demand curve

The World Bank has indicated critical minerals production could increase by nearly 500% by 2050 to meet t he growing demand for clean energy technologies.

It estimates more than 3 billion tonnes of minerals and metals will be needed for the wind, solar, geothermal power and energy storage requirements of projects to be built to meet carbon reduction targets.

Australia, has good reserves of many of these critical minerals.

US Geological Survey figures show Australia has the world's largest reserves of lithium and second largest of nickel.

It is also strong in other metals such as copper, iron ore, cobalt and vanadium.

The problem for Australia is a lot of the easy-to-access deposits already have been.

However, they have left behind some fairly easy-to-access tailings dams.

MRIWA estimates the value of precious, critical and strategic metals contained in tailings worldwide to be more than US$3.4 (A$5.2) trillion.

Imdex chief geoscientist Dr Dave Lawie said technology could help tailings and define the ore to enable extraction.

The old mines down the road

Lawie said as well as reassessing tailings, there had also been a shift in sentiment, particularly in Europe towards bringing old mines back into production.

"You could probably bring these mines back with much less community and environmental impact and much better ESG credentials," he said.

"There seems to be a realisation now that we do need these metals and it seems to be becoming more acceptable now to try to restart this activity in Europe.

"To do something with tailings you need to understand what is in the tailings, some of which have been in place for 100 years and there's no record of what is in them.

"But if you want to make a case to reopen them in some way it's very difficult to make an economic case unless you know what's in them, and that's the role of technology."

Federal resources minister Madeline King said the GA Atlas of Australian Mine Waste could provide industry with additional opportunities to extract resources from previously mined rock and earth.

"Some of the minerals we need now, and into the future, may not just be in the ground – they're also in rock piles and tailings on mine sites around the country," King said.

"These minerals might not have been of interest when first extracted but could now be in hot demand as the world seeks to decarbonise – for example, cobalt in the tailings of old copper mines.

"This new atlas puts these potentially lucrative sites on the map for the first time and may open new sources of critical materials.

"Our resources sector is the key to our net zero future and this is another tool developed by government to help facilitate the discovery of critical minerals in a more efficient, sustainable way – and to the highest standards.

"Reprocessing rocks and earth that have been previously excavated during mining operations can give new life to old mining towns, create jobs and rejuvenate local economies."

Regeneration

Lawie said reprocessing offered value by recovering valuable materials left in tailings by past inefficient mining practices, finding new uses for tailings and by creating value from an asset that would otherwise by a liability for miners.

"Some of the older processing plants and processes weren't as efficient compared to today's technology and the recovery might have been 70-80%, meaning 20-30% of the valuable material is still sitting in the tailings.

"Another value is the material itself. There is research being done because material that has been through processing and are in tailings is special material.

"Groups such as Regeneration are involved in research to determine what you can turn tailings into and they're developing projects focused on remining and restoring legacy mines.

"If we put our minds to it we'd probably be able to transform them into specialised building materials. They'll have certain thermal capacities so we might be able to make insulation panels or bricks that are resilient to losing heat in houses.

"Then there is putting a dollar value on the liability mining companies carry for the tailings. Reprocessing the tailings means you can potentially turn it into something valuable and there are environmental credits for remediating these areas."

Regeneration Enterprises aims to capture the metals and minerals from mine waste and put it back into the supply chain or repurpose it for other uses.

Earnings and credits are used to help fund nature restoration and bring closure to communities.

The reclaimed minerals and metals would help meet increasing demand.

Regeneration chief innovation officer John Thompson said this posed a real challenge.

"It's easy to say we're going to remine waste but it is difficult to do," Thompson said.

"We will need technologies and partners."

Rio Tinto was Regeneration's first investor and is a site and technology partner. Apple and Tiffany are also on board.