Where can miners turn to get light vehicles if they are to do away with their diesel-burning utes in an effort to cut emissions? Research by Australia's Mining Monthly shows the options are limited.

The idea that electric light vehicles would provide miners with some low-hanging decarbonisation fruit encouraged several companies to enter the ELV arena.

However, it turns out most miners just want something that is readily available with runs on the board. And while they would like some electric utes, they would much rather get electric trucks and loaders.

Here things differ a bit in terms of whether the mine is at the surface or underground. If it is underground the electric trucks and loaders are already available. A report by Perenti, IGO and ABB found that an electric underground mine was feasible given the technologies available.

YOU MIGHT ALSO LIKE

Original equipment manufacturers have been producing battery-electric underground trucks, loaders and drills for the better part of a decade. An imperative to reduce the diesel particulate emissions in underground operations drove developments here. Those efforts have proved prescient as miners started releasing net-zero emissions targets.

On the surface it is a different story.

Diesel particulate matter is not such a problem. On the surface the answer is blowing in the wind.

The sheer size of the equipment used on the surface is a problem. Considerably more batteries are needed for a 220t surface truck than for a 65t underground hauler.

It is unlikely a commercially-available surface battery-electric haul truck will be available before 2027. And word is if orders have not been placed for an electric haul truck by now, then there will not be machines available before 2030.

When it comes to electric light vehicles, the options in Australia are just as limited.

Indeed, the Perenti, IGO and ABB study actually flagged this lack as an issue, although it did point to the Zero Automotive conversion of diesel Lancruisers to battery-electric as one of the options available.

Size matters

The problem for miners is partly one of market size.

BHP's entire Australian light vehicle fleet is about 5000 vehicles. Fortescue has about 1500. Rio Tinto's fleet numbers would fall somewhere between those. In the global mining market the entire light vehicle fleet is about 200,000 vehicles.

Toyota sold more than 60,000 Hiluxes in Australia last year.

In the Australian ELV mining market there are only three off-the-shelf options. The rest are diesel utes converted to battery-electric, and most of those require a donor chassis for the transformation.

Indeed, in May, the field of ELV suppliers was reduced by one, with ROEV deciding to give up on conversions and instead focus on its software that helps fleets choose the best ELV option.

The problem the converters face is the time it takes to transform the vehicles from diesel to battery-electric.

The only real conversion options at this stage are Zero Automotive and MEVCO.

There is the Bortana, being championed by Safescape's Steve Durkin, however, that is not likely to go into production until next year.

Voltra, the company that first came to public attention for providing a battery-electric conversion of a Toyota Landcruiser for BHP's Olympic Dam mine no longer seems to be in the ELV game.

Ampcontrol has created the Driftex, an intrinsically safe battery-electric personnel carrier for underground coal mines.

Off-the-shelf

Two of the three off-the-shelf offerings are from the US.

One is from Ford, in the form of the Lightning, the battery-electric version of the F100 truck. It is much larger than the Toyota Landcruiser most miners are used to.

It is not, however, the first time a truck that big has gone underground. In the naughties Byrnecut trialled some Dodge Ram trucks underground, albeit in the diesel form.

What might be a problem for some is that it is not Ford Australia bringing the Lightnings in.

According to Ford Australia, the only thing it has coming is the Ford Ranger Plug-in Hybrid.

That will come with a 2.3 litre Ecoboost turbo-charged engine with a parallel electric motor assist. The problem for miners is, that engine will be petrol only.

A Ford Australian spokeswoman said the F-150 Lightnings remained in left-hand drive only and would be unavailable for sale from Ford Australia.

"Ford Australia has not remanufactured any F-150 Lightings to right-hand drive," she said.

Luckily for miners, GB Auto has. It is importing the vehicles and, for miners, setting them up to mine-site specification.

It does not sound like there will be much change from $200,000 if a miner wants to buy a Lightning.

The other US off-the-shelf option is the Rivian.

The New York Stock Exchange-listed company's vehicles will be brought into Australia's mine sites by Mevco.

While the Rivian has some impressive off-road credibility it has not been tested in a mining environment.

It also does not come with a tray. The Rivian is tub only. That may prove problematic.

Another thing to factor in is both the F-150 Lighting and the Rivian, while being serious off-road vehicles, have sports car like performance and 0-100kph speeds around the four second mark. That may concern some mine safety bosses.

The third off-the-shelf option is from German automaker Huber Automotive. Its eLC70 is a battery-electric version of the Landcruiser. Technically it is a conversion, however, for a mining company purchasing them it would be like buying one off the shelf.

Looking a little bit left field, there is also the Tesla Cybertruck, although nobody is seriously considering that as a light vehicle for a mine site. Given the advances in Tesla's self-driving technologies, it could provide country and western songwriters with another twist, where the truck leaves him, too.

So why has it taken Toyota so long to come up with a battery-electric off-road option? After all, it struck a partnership with BHP to develop an ELV in 2021.

Toyota walks the talk

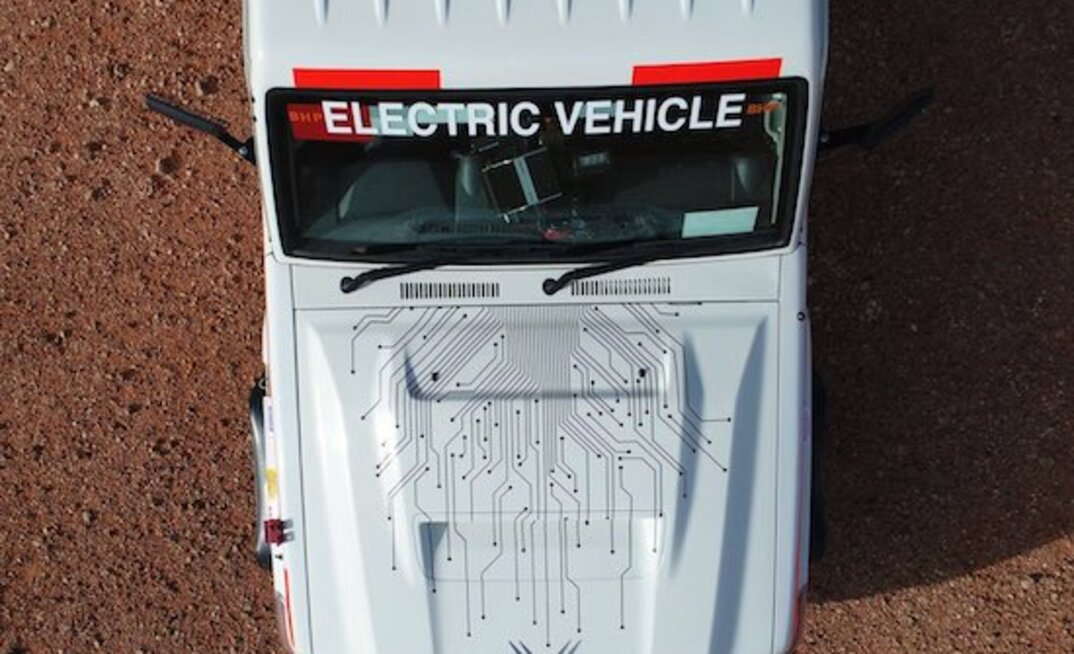

Toyota finally bit the bullet and delivered a battery-electric Hilux dual cab prototype for BHP to test in Port Hedland for a year.

It makes good on a memorandum of understanding BHP and Toyota struck last year to look at developing a mine-suitable ELV.

There were also trials of a converted Landcruiser 70 series were conducted in South Australia and Queensland, however, a finished vehicle is yet to eventuate.

One theory widely held in the industry is that Toyota is looking at hydrogen rather than batteries to replace diesel for the Landcruiser.

Toyota also announced a 48-volt mild-hybrid version of the Hilux, which comes with a 2.8L turbo-diesel engine.

That may prove helpful to miners.

Thiess has been experimenting with EVs. It introduced two EVs, a Polestar 2 and Kia EV6, and a Mitsubishi Outlander hybrid to one of its New South Wales as pool cars for a trial.

The vehicles have let its workers experience driving EVs. It has also installed two ABB 22 kilowatt electric chargers to support the trial. A third charger was installed for use by employees and visitors who drove EVs to site.

ELV insight

Financier and advisor Lex McArthur has some insight into the mining sector's ELV needs.

He was at RCF Jolimont when it formed MEVCO and chaired the company for a while.

"There will be a lot of utility vehicles coming down the track," McArthur said.

"BYD is coming out with a hybrid, the Shark.

"I'll be surprised if we don't have something from Toyota in the next five years.

"But miners can't wait. Fortescue has net zero from 2030.

"They are getting desperate."

A Fortescue spokeswoman said the miner would be replacing its fleet of 1500 light vehicles with zero-emissions alternatives as part of its commitment to decarbonise its operations.

"We are working with prospective providers and collaborating with contractors to explore our options," she said.

In December 2023 Fortescue announced an extension of its partnership with First Nations business Kooya Fleet Solutions to provide 100 electric Tuatara Ultra Terrain Vehicles across Fortescue's Pilbara operations.

"There are a couple of mining companies that will lead the way with this," McArthur said.

"One is Fortescue. Hancock is another. I think Vale, with Mark Cutifani as chairman, will be the fastest to transition its fleet. Mark has always been a champion of net zero."