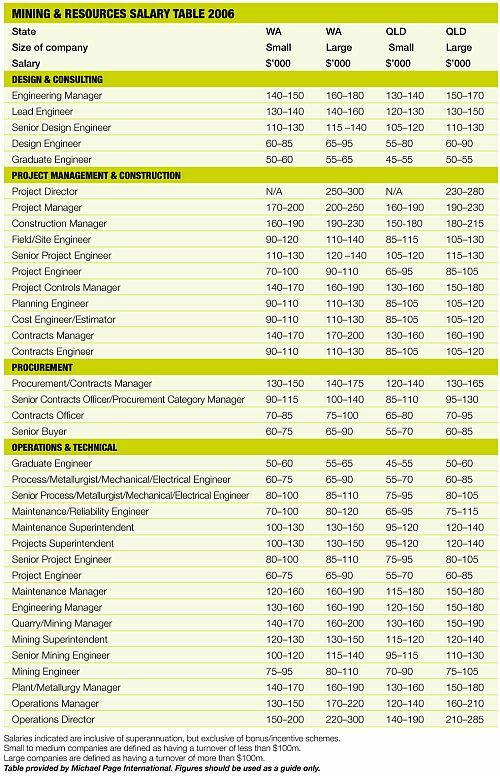

âCompanies mining iron ore and coal are offering salaries that simply cannot be matched in an effort to offset the diminishing talent pool and retain high calibre workers,â Michael Page Western Australian associate director Simon Lynch said.

The annual Michael Page Salary Survey shows a shortage of engineers, supply chain professionals and procurement specialists across all industries and states, particularly in Western Australia and Queenslandâs mining and resources sectors.

The survey found both permanent and contract recruitment remained buoyant due to a lack of quality candidates.

In particular, the shortage of mining engineers is seeing company recruitment strategies aimed at the graduate level with companies targeting potential candidates prior to graduation.

The survey found talent retention was a key focus in the mining industry and the dominant players have established performance and loyalty bonus schemes to retain staff in the face of emerging competitor organisations.

âWe anticipate strong employment activity for the next 12 months to support continuing growth of the resources sector. Extremely high levels of confidence within the sector has led to companies investing more in their employees,â Lynch said.

The salary survey found over the past year permanent salaries had clawed back some of the ground lost to contracting rates in 2005.

âThe permanent recruitment market is experiencing a short supply of mining engineers, mechanical engineers, electrical engineers and procurement and project controls professionals but is gaining some ground through employee âbuy backâ salary negotiations,â he said.

The survey also found contracting was a popular choice with many white-collar workers because of the flexibility and financial rewards on offer.

âHourly rates are the primary bargaining tool and employers are having to dig deep and pay for hard-to-find skills sets. All indicators point to a continued labour shortage in which contract workers are in high demand and in strong bargaining positions,â the company said.