According to sector experts Carl Tom Blevins and Alan Campoli, who developed a retrospective study on resin developments for the 25th International Conference on Ground Control in Mining, the use of rock bolting was not seen on an industrial scale until about 1947. Concerns over roof fall accidents prompted the then US Bureau of Mines to present bolting as a more effective mine roof stabilizer.

By the early 1950s, more than 25 million roof bolts were in use each year, primarily mechanical point-anchored. It did not take long, the two experts noted, before that design was found to have an inherent limitation when used in deformation-prone weak strata.

In 1956, synthetic epoxy resins were first introduced to a US industry that had an open mind about the potential for bolts to be anchored only by a material that would work with a bolt to provide reinforcement immediately after placement.

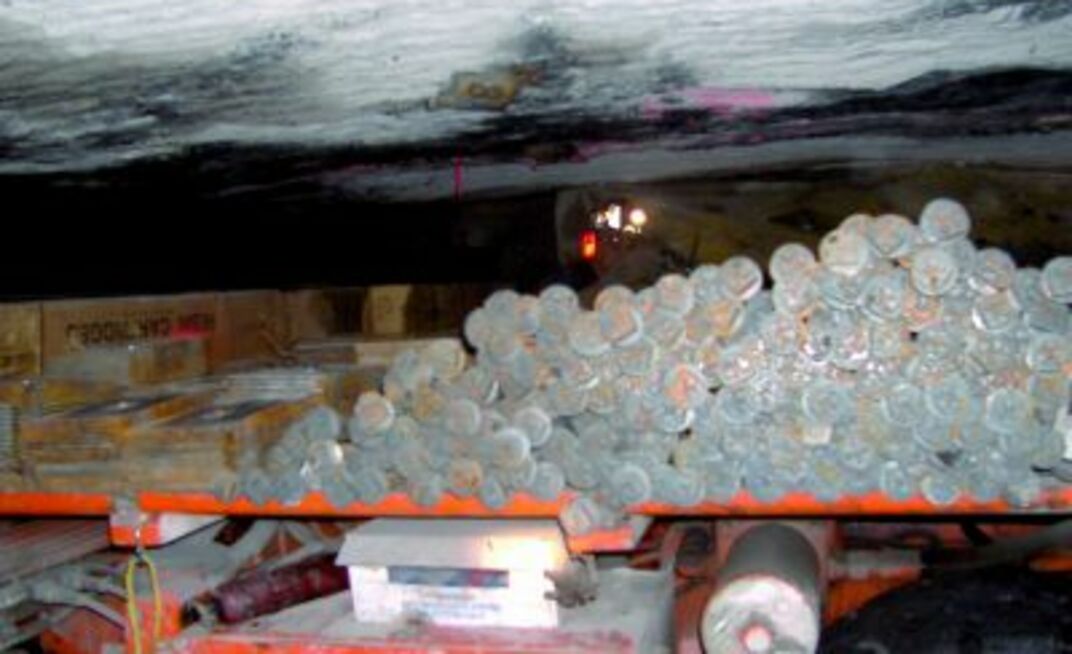

Technology grew over the decades, with a milestone arriving in 1998 when more cost-efficient No. 5 rebar bolts were approved for mining, virtually replacing the mechanical point anchor with fully grouted resin rebar.

Currently, 80% of the more than 100 million installed roof bolts each year for mining, as well as tunneling and construction, include polyester roof bolt resin.

An improved design and manufacturing process has also made them more affordable, with an inflation-adjusted dollar having the power to purchase six times more resin in 2006 than in 1974.

Today's cartridge design effectiveness is thanks to a chemical reaction of two separate elements which mix and harden, and will not react with rock or rebar. It also protects the bar from corrosion and the rock from weathering. Set, or gel, times for modern polyester resin cartridges can vary from a few seconds to two hours, and some mixtures can be affected by temperature.

The current bolt of choice in mines, according to the two experts, is fully-grouted non-tensioned rebar under diverse conditions. There is debate, however, on whether pre-tensioning boosts the performance of roof supports.

"Respected expert opinions on the subject vary from pronouncing pre-tensioning as absolutely unnecessary, to attributing report success to installed tensions of up to 25,000 pound force. Unfortunately, direct scientific experimentation has not yet confirmed either opinion," the experts noted.

The vital question going forward with roof support research is the relative value of high-tension systems, as that is generally thought to be needed where "stack rock" conditions require that compression be used on the roof's surface to prevent roof layer delamination.

The two experts also looked specifically at fully-grouted rebar systems, the effectiveness of which is dependent on many factors working together. One of the most significant variables in resin bolt performance is its annulus size, known as the difference between the hole and bolt diameters.

Most resin applications in the US call into one of three specifications: the A, B, and E (Minova) and H (Fasloc) Series. Each carries its own bar and cartridge size as well as hole diameter for an individual annulus result.

Chemical grouting material standards

Under Part 30, Section 75.204 of federal regulations, bolts and accessories must follow the specifications of the American Society for Testing Materials titled "Standard Specifications for Roof and Rock Bolts and Accessories", or F432-95. There were no standards in roof bolt resin prior to 1999 when those outlines were implemented, Blevins and Campoli noted.

Until that point, each manufacturer largely made its own decisions on design guidelines as well as testing, manufacturing and labeling. Both Fasloc and Minova played a role in developing a threshold for minimum performance across the industry that encompassed five issue criteria: strength index, speed index, cartridge equivalent length, grout application class and product marketing.

Under the grout application class, the ASTM regulations require chemical grouting material assignment into product application classes I, II or III. Class I means the materials are fully grouted or partially grouted, non tensioned; Class II is a supplement to mechanical and anchorage devices; and Class III is for chemical grout, only tensioned. Products can be designated under multiple classes, but the experts note that both Fasloc and Minova offer products that are Class I, II and III.

Marketing requirements were also determined for chemical grouting materials. While cartridges are required to be marked individually, the cartridge's container labels must have five items included.

The first is general product information, including formulation designation, the manufacturer of the units and the number of cartridges inside the container; a recommendation from the supplier on hole and bolt diameters and cartridge equivalent length; the application class, speed index reading and length/diameter of the cartridge, as well as its use-by date; and its strength index and recommended mixing time and speed.

As further research and development in the area of resin roof bolting continues by companies across the county, the two experts said the resin sector is flexible and will be positively impacted by technological advancements.

"The resin industry will adapt to meet the future demands and expectations of the US mining industry."