Epiroc is in the very front rank of equipment providers leading the way in mining automation, propelled by a distinctive agnostic stance that means the company works with a wide range of partners and customers. That openness is being rewarded by continued growth in mining for the Swedish giant, aided by strategic mergers and acquisitions that align with its vision.

The trend towards automation, electrification and digitalisation is of course predicated on the promise of greater safety, efficiency and holistic control of operations. With its formidable heritage in applying technology and innovation, Epiroc is well positioned to accelerate industry progress and meet fast-evolving customer demands. A notable USP here is the company's approach to openness, practical collaboration and partnering where necessary to suit the needs of customers targeting efficiency, safety and sustainability.

Epiroc's success is bolstered by a bold approach to M&A where recent activity has included the purchases of RCT and ASI Mining. The purchase of Perth, Australia-headquartered RCT late in 2022 strengthened Epiroc's hand in remote control and automation solutions while the 2024 capture of surface mining autonomy leader ASI complemented that deal as both companies are also focused on supporting mixed-vendor fleet equipment operations.

RCT chief executive officer Brett White said Epiroc and RCT were aligned in many ways.

"RCT began life as an independent provider of technologies and becoming agnostic was the way to make a dent and to take market share," he recalled. "We wanted to control any type of machine – anything that has tracks and tyres. We created a generic platform that now has 40% market share, battling against monstrous equipment makers. We're a big player and it's all been about that agnostic approach. Epiroc becoming agnostic is the most compelling shift in approach I've seen for quite a while. It allows miners to express OEM preferences or deal with equipment supply-chain constraints and it stops them being locked in or at the mercy of a single supplier, whilst allowing all of their automated assets to be under a common ecosystem."

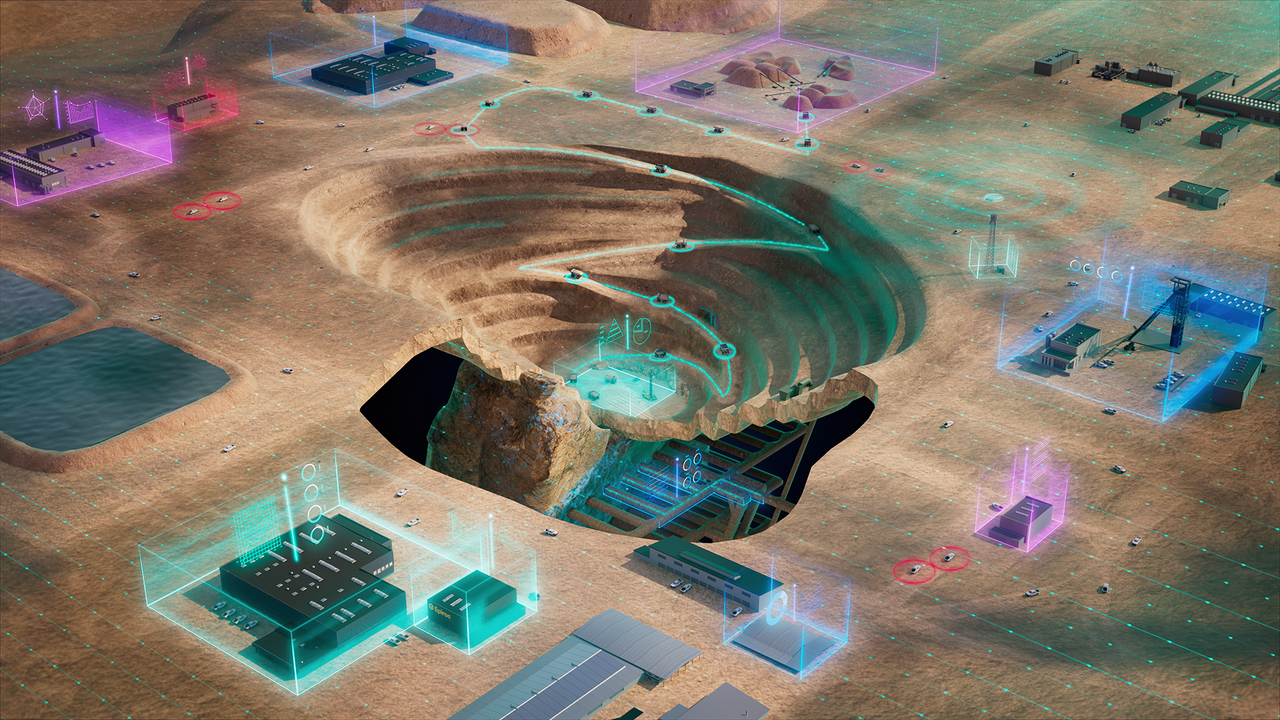

The net result of such deals is that Epiroc has end-to-end surface and subterranean mining automation capabilities spanning connectivity, planning, fleet management, traffic monitoring, operations, protection, data analytics and sustainability. The company is at the vanguard of a new front in mining where operations are no longer gated by equipment brands and models or closed management systems. This openness speeds deployment and ensures that customers gain an optimal return on investment and support longevity from their purchases.

Shared visions

"We primarily specialise in haul truck automation for surface mining and our competitive advantage is that we're open: we automate any truck regardless of brand, model or age," said Epiroc's general manager for surface mining automation (haulage), Diederik Lugtigheid, – a former executive at ASI Mining. "Komatsu or Caterpillar provide similar solutions only on their own brand of trucks and they lock you into their brand through the automation platform. It's like the printer business where if you buy an HP printer you're locked into their proprietary printer cartridges forever and a day. Our automation platform disrupts that business model and aims to give flexibility to mining companies. We provide an Autonomous Haulage System (AHS) that is open and agnostic; we don't care what fleet our customers run, mixed, old or new – if they want an AHS solution we can do that for them. Also, our overarching automation platform is designed to provide a mine automation system that manages different islands of automation in the mine: haulage, drilling, dozing operations, etc. Epiroc has decided it wants to play a bigger role in surface mining and have an arsenal of solutions in the overall surface mining business. The orchestration and traffic management bit we provide is about executing those tasks reliably and repetitively with fewer errors and greater efficiency. Epiroc is a huge game-changer for us. We now have physical presence in all the major markets: Chile, Peru, Brazil, Canada, South Africa, the US. The other big thing is it gives us the backing of a very large OEM. We were the new kid on the block and companies were logically nervous about the vulnerability that brings, but now we are part of a major player in the mining industry and an important part of its overall growth strategy, which brings a very different dynamic."

The art of the deal

Epiroc vice president automation (digital solutions division) Ashleigh Braddock added:

"Epiroc has a very long history with automation and a long history of firsts developed with our equipment. Now we look at how we can support our customers better and we understand they want the freedom and flexibility of a more agnostic approach. You see that in our acquisitions of ASI for surface haulage and RCT for the underground space. Being agnostic is closely matched to our culture and it's a unique characteristic. We're very collaborative as a partner and it's all about how we support customers better, to deliver the best solutions and not to block the customer in or restrict their operations.

"We have a build-partner-acquire approach. Not everything needs to be made by us and there are areas where we aren't strong, so we're willing to partner and acquire. We try to provide end-to-end value because it's very difficult for miners to digitise in pieces."

Braddock said that experience in acquisitions is paying off. Acquisitions are framed by not only "standalone attractiveness" and performance but also culture, she added. "We ask ‘Is it a strategic fit with Epiroc? Does it support the core business and is it the right cultural fit? And also does it have the potential to become or remain number-one or number-two in its market?'"

"It's very much a people game and integration is key," she said. "A lot of what we've acquired is talent: fantastic people and key characteristics, and we want to incubate as much as possible. I don't know that we have a specific playbook because each approach is unique but given that we've made acquisitions since 2019 we are getting better and for sure it's a learning process.

"With our unique approach we're driving flexibility. Some of the larger mining houses have had that ability to drive automation but we want to make that available to everyone. It shouldn't just be for a BHP or Rio. We're trying to imagine a different mining environment for the future and removing people from hazardous environments. Electrification and automation go hand in hand and they lead to step changes in efficiency gains and in the ability to drive more productivity. It's a very exciting time to be in the mining sector."